Form I-864EZ or Form I-864 needs to be filed to show ability to financially support the Green Card applicant

- Who is filing Form I-864EZ: (Spouse) U.S. citizen

- Who is filing Form I-864: (Spouse) U.S. citizen and/or (non-spouse) U.S. citizen

- Filing fee: $0

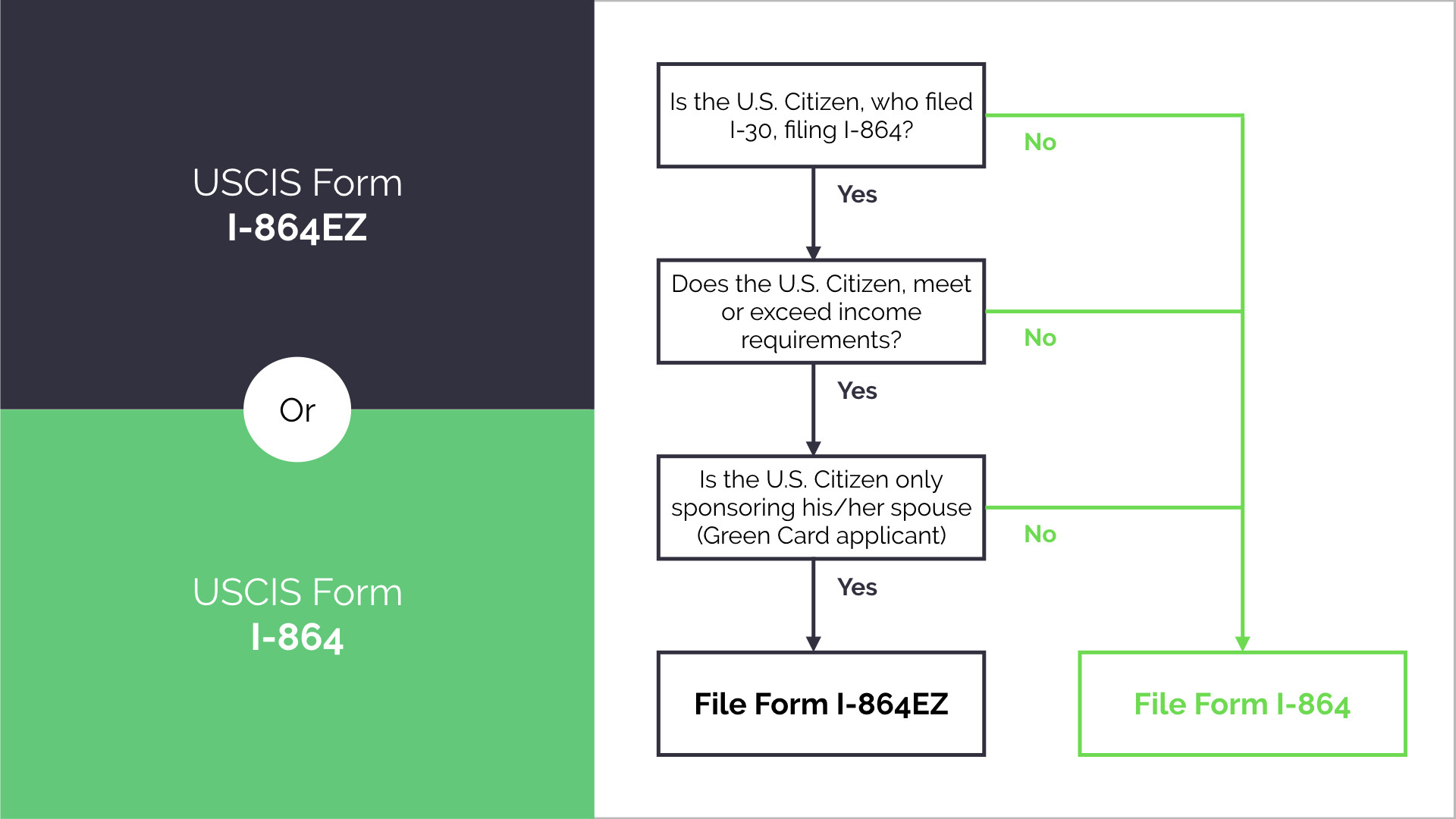

This page contains step-by-step instructions that will help you determine which of the two variants of Form I-864 do you need to file.

We recommend you file Form I-864EZ instead of Form I-864, if you’re eligible, as it will save you quite a bit of time and effort.

Form I-864EZ or Form I-864 Eligibility Instructions

Like the name suggests, Form I-864EZ is easier to fill out than Form I-864. To be eligible to file Form I-864EZ, ALL 3 conditions below must be met:

- Form I-864EZ is being filed by the U.S. Citizen, who is filing Form I-130

- The Green Card applicant is the only person listed on Form I-864EZ

- Salary or pension earned by the U.S. citizen meets or exceeds income requirements

- The Income Requirement varies based on the household size and location

- Your total income should be greater than the amount shown in ‘125% of HHS Poverty Guideline’ column on Federal poverty guidelines page

- To calculate your total household size, add:

- You

- Your spouse

- All dependent children under age of 21

- Anyone else the U.S. citizen claimed as dependents on the last Federal Returns, regardless where they live

- Anyone else that the U.S. citizen has previously sponsored using Form I-864, and is still obligate to support

- To calculate your total household size, add:

If ALL 3 conditions listed above are met, you can file Form I-864EZ. If not, then you need to file Form I-864.

That concludes the instructions for this page. If you have any thoughts, questions, or clarifications on these Instructions, feel free to ask and/or discuss them in the Marriage-based Green Card discussions.